|

[VIEWED 33620

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

jhyalincha

Please log in to subscribe to jhyalincha's postings.

Posted on 12-26-06 4:41

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I have been reading the other thread (bumper yield on wall street) and it makes for some good read, but it is also not really helping a lot of nepalese that have little or no experience/knowledge about the market. I am reading up on all these proclamations by the threaders (and maybe they are telling the truth), but I can easily see the ramifications -- ever seen those auto commercials where they say 'do not try this at home"? This is one of those things. Forget options, futures and currency swaps unless you know what you are doing. Heck, even stay away from individual securities if you can help it. for beginners, go after mutual funds. try cheap mutual fund houses such as Vanguard, Trowe and Fidelity. go to morningstar.com and look for the 4 and 5 stars; and then most important, create a well diversified mix--have proper controls in place so you dont have everything correlated to the market; go after index funds to minimize costs, and place your equity exposure in accordance to your age (for example, if you are 30 go after 30% in bonds and cash and the rest in stock exposure) by the same token within the stk exposure break it down 50/50 between domestic and international-- choose an index fund copied around the wilshire 5000, and an international index fund chasing the msci (international index)---with fixed income (bonds) have 1/3rds in mmkt, an bond index fund, and a high yield. there, that should do it. Dont forget to rebalance it every year though.

|

| |

|

|

|

|

highfly

Please log in to subscribe to highfly's postings.

Posted on 12-29-06 2:06

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Anybody intrested in some groups like google or yahoo. We can do research on ceratin funds, stocks or other investment and post result in group. This way we will have more sorted out info to be used for investment. Just a thought. peace out

|

| |

|

|

haami

Please log in to subscribe to haami's postings.

Posted on 12-29-06 2:19

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

in fact I was thinking of the same highfly. Anybody willing to volunteer in creating a yahoo group? thanks, haami

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 2:42

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Lets contact San and ask him to create something right here.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 10:42

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

just a bit of deviation: SADDAM'S DEAD!!!! YAY!!!

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-30-06 7:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

just keepin this thread alive...

|

| |

|

|

Hi_nanu

Please log in to subscribe to Hi_nanu's postings.

Posted on 12-30-06 7:19

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

What kinds of effect saddam's execution will bring into stock market?Any thoughts...

|

| |

|

|

kalebhut

Please log in to subscribe to kalebhut's postings.

Posted on 12-30-06 10:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Stock exchanges in China are still at its initial stage of development.The best way to invest in China is to look for Chinese stocks listed in HK stock exchange ..also collectively known as H shares. Hong Kong’s benchmark index (HSI) has hit a record high at 20000 few days ago. Besides, Hong Kong exchange has been a productive place in raising capital or IPOs of Chinese companies in recent times. Thanks to the British colonial rule, HK has achieved the status as world’s financial centre in just 20 years to what it took 300 years for London to reach the same stage. As a rookie.. myself, I have no exact recommendations on Chinese stocks. I would suggest you to diversify at least 10% of your portfolio in china related investments, so that in case of the crisis it will have little effect on your portfolio. China’s volatile economy and HK’s service based economy could be a serious threat for small investors and traders alike. You may also want to check all the investment opportunities with your brokerage companies, before you put your money in China. To nanu’s question.. Saddam’s execution will have no effect in stock markets around the world other than few protests of human rights violation in places like Nepal and of course in the media etc. But violent retaliations by the sunnis muslims could lead to more chaos in Iraq as well as fluctuations on crude oil prices. Rise in crude oil prices could slightly affect the stock markets but you should be safe in your investment goals

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-30-06 11:16

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

One of the strategies used by many mutual fund managers is to buy the top performing sectors in the 1st two weeks of the year. Most of the mutual fund managers are chasing performance so they will buy what is hot at that point. I will post what sector is hot after 2 weeks. I would not be surprised if we see some type of correction here. S&P is currently at 1420 and 1320 was the previous resistance. The markets have a tendancy to test the previous resistance before going to a new high.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-31-06 1:04

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

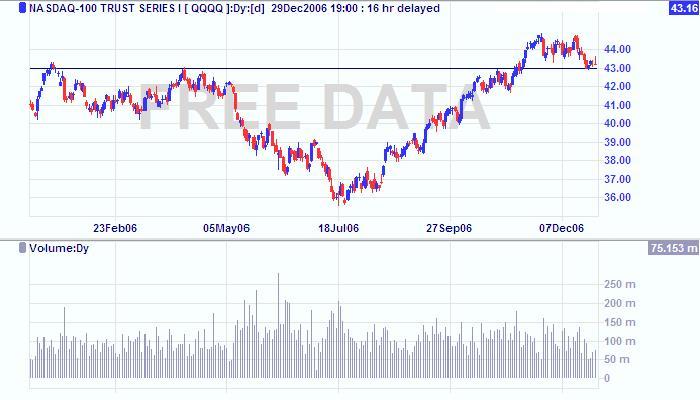

I agree with eminitrader. Look at the chart of the QQQQ fellers. If this baby breaks through that long black resistance across the chart and goes downwards, I believe it is an early sign that overall markets will see a correction. For those who don't know what the QQQQ is, in layman's words, it just tracks the 100 top stocks in NASDAQ and are highly correlated with NASDAQ. It's an ETF- Exchange Traded Fund. In my previous post I explaiened to someone that an ETF is like a mutual fund, except it can be traded like stocks. Tracking this can show early promising signs of overall market conditions

|

| |

|

|

latoboy

Please log in to subscribe to latoboy's postings.

Posted on 01-07-07 10:52

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

anyone here have the motley fool 2007 stocks guide ??

|

| |